Welcome to the second issue of Conversations@Tangible for 2022. We have reached our 40th issue; what a milestone! Thank you for all your support on Conversations@Tangible. To celebrate this milestone, this issue will focus on a new and exciting investment asset class today, NFTs. So whether you are a new crypto or tech bro, an avid NFT collector, an investor getting into this crypto-space or just curious, this edition is perfect for you!

Bored Ape Yacht Club (BAYC) | Yuga Labs

Preface

In our culture today, where tech meets real life, we can make our random doodles in our notebook for 1 ETH ($1691 as of 28 June 2022) today. As we sit in the web3 culture today, the blockchain space is a burgeoning industry where even tech founders admit to being in the midst of a learning curve. Cryptocurrencies, utility tokens, security tokens, digital assets, new exciting investment asset classes and their sub-classifications are multiplying and evolving alongside cryptographic and blockchain technology. One booming market now is the non-fungible token space.

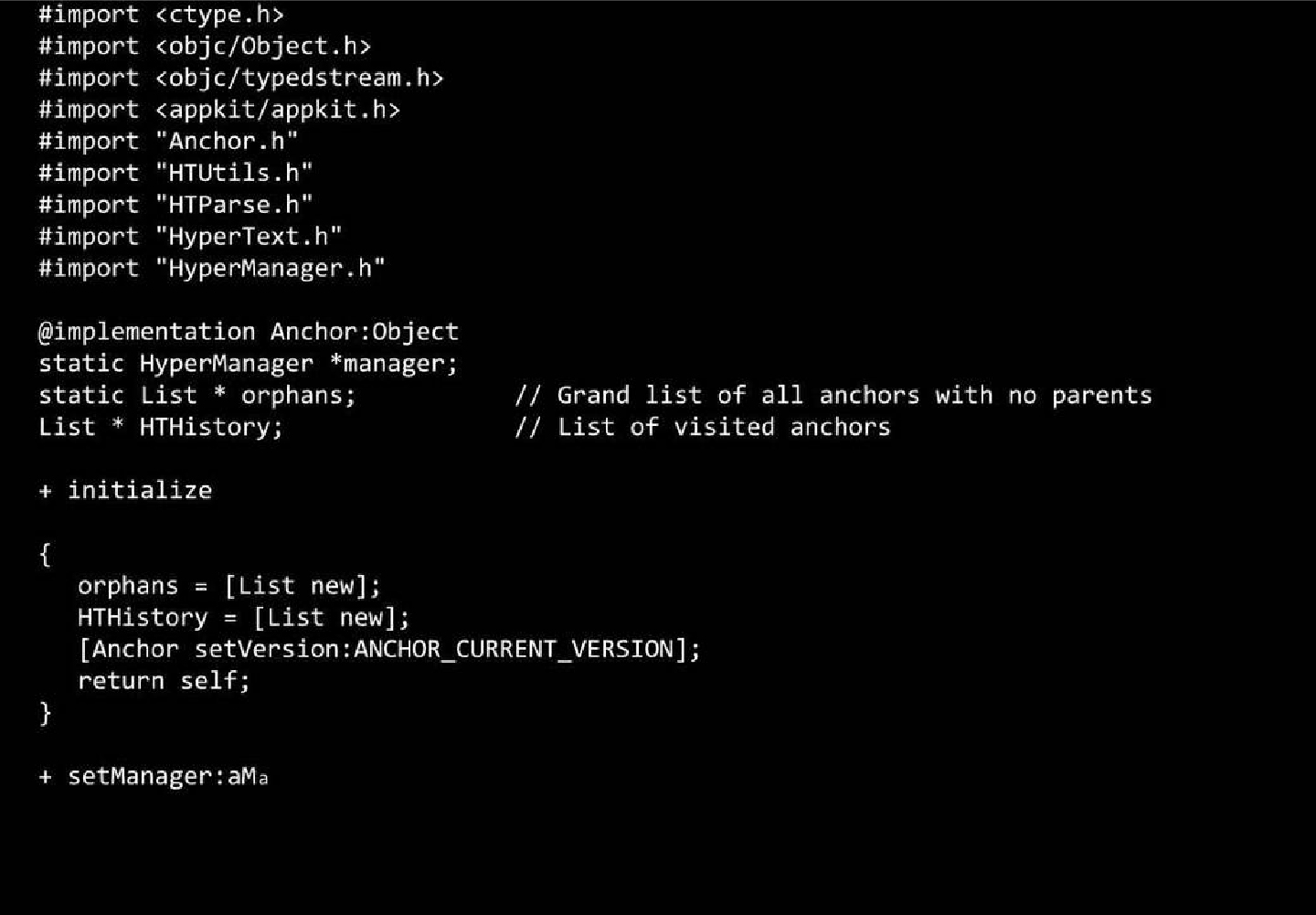

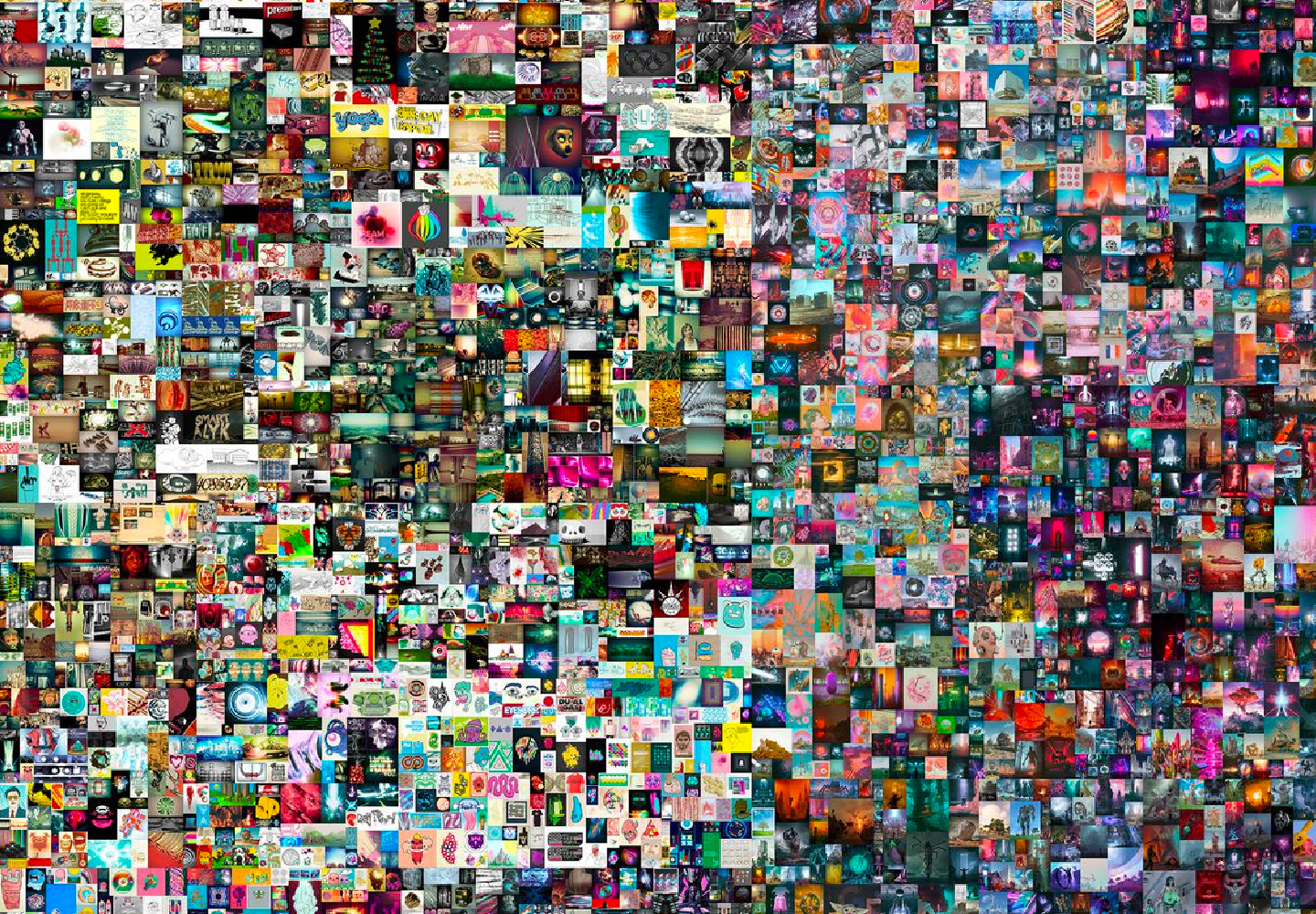

BEEPLE: Everydays, the 5000 images | Christie’s Auction House

Introduction

How much can a cluster of pixels be possibly worth? In today’s world, where anyone can just save an image from anywhere on the internet within seconds – a collection of pixels is probably worth nothing. However, in March 2021, a digital print called Everydays: The First 5000 Days sold for $69 million at Christie’s Auction House. It is not extraordinary to see an eight-figure art sale at Christie’s, but selling the work of art as a non-fungible token (NFT) is a first of its kind. To put it into perspective: Someone paid $69 million for a collage of 5000 digital images. How crazy is that?

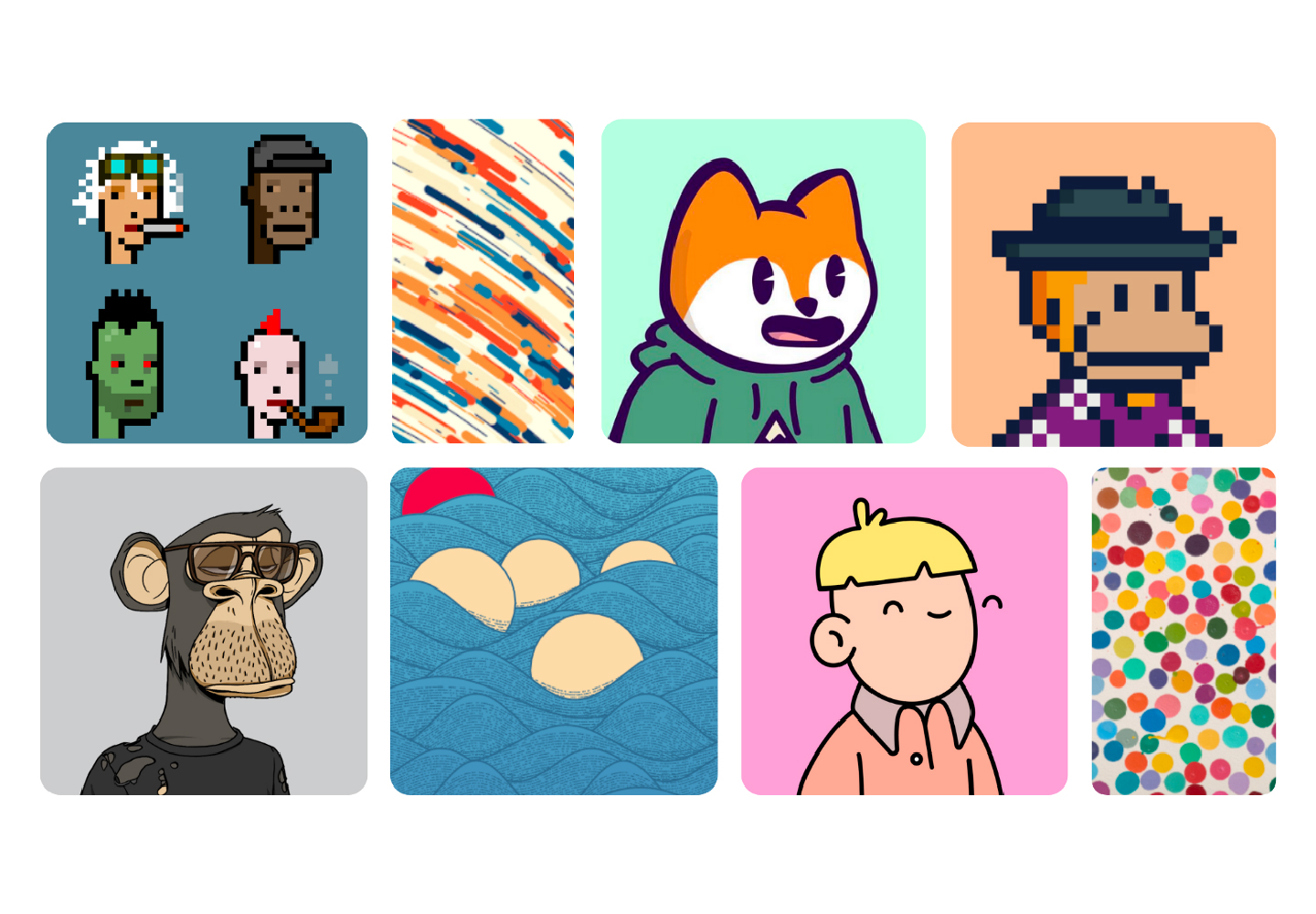

Top: Crypto Punks, Wavelength by Kaleb Johnston, Famous Fox Federation, And Solana Monkey Business.

Top: Crypto Punks, Wavelength by Kaleb Johnston, Famous Fox Federation, And Solana Monkey Business.

Bottom: Bored Ape Yacht Club, Getijde by Bart Simons, Doodles,

and The Currency by Damian Hirst | Medium.com, A Primer to NFTS

So, what is an NFT?

Non-Fungible Tokens or NFTs are digital assets with a unique identity kept and verified on a blockchain, a digital ledger that is encrypted and safe. Each NFT has a signature that allows anyone online to verify its authenticity, transaction details, time, and cost. Each NFT is non-fungible, meaning the NFT cannot be exchanged for another asset of similar value. For clarification, NFTs are neither a platform, a currency, or a marketplace. Common NFT assets can be images, videos, music, a soundtrack, collectibles or even shoes; anything that can be made digital can be an NFT.

Understanding the difference between non-fungible and fungible assets will help you know NFTs better. Stocks, money, oil, gold, and cryptocurrency are fungible; they can be easily traded or exchanged for an equalised value – $1 for $1. Non-fungible assets are different; they have a unique code attached to them, and their properties are not transposable and cannot be replaced with a similar item.

This Changed Everything: Source Code for WWW x Tim Berners- Lee | Sotheby’s

How does NFT work?

Think of NFTs as a collector’s item but in a digital format. An artist or creator can create an NFT by converting images, music, art, and videos into crypto collections or digital assets and storing them onto the blockchain – and this process is minting. By minting an NFT, you convert tangible digital files into encrypted, unique non-fungible tokens for buyers to take an interest in. NFTs exist on blockchain technology, the recorded provenance of the digital asset makes it unique and safe to invest in, and you will never lose it with the technology attached. NFTs hold value because there is only one unique version of the asset that is made and cannot replicate, a 1:1 in layman’s terms.

With NFTs, everything is made digital. When you buy an NFT, you will not get the physical asset; you will get a digital file and exclusive ownership rights tagged to the investment.

Dictador x Richard Orlinski NFT, about $45,000 | Financial Times

What can be converted into an NFT?

Anything digitalised can be turned into an NFT, even a tweet! Twitter’s former co-founder Jack Dorsey sold his first tweet as an NFT for more than US$2.9 million. Anything can be converted to an NFT, from artwork, music and media, to trading cards, event tickets, in-game items on gaming platforms, memes, and even real-world items like collectible Nike shoes and rare spirits.

Illustration by Mengxi Li | The Verge

Illustration by Mengxi Li | The Verge

How to make NFTs?

Before making NFTs, some NFT jargon might help you ease your way into the NFT space. Some important ones are:

- 1:1 Art: A unique NFT art piece that only exists in one edition

- Altcoin: An Altcoin is an alternative digital currency to Bitcoin. The word Altcoin is a portmanteau of “alternative” and “coin” to form “altcoin”. It refers to a group of cryptocurrencies, ultimately all the cryptocurrencies other than Bitcoin.

- Airdrop: New NFTs or cryptocurrencies are automatically sent to your wallet for free.

- Bearish: This term is used when traders, investors and community members expect a token or asset’s value to decline soon.

- Bullish: The opposite of bearish.

- Discord: A social media platform akin to slack, built initially for gamers but has since evolved into a platform for all kinds of communities, especially for NFT projects.

- Gas: Gas is the amount (in native cryptocurrency) required by the platform or marketplace for a user to perform transactions on the blockchain. For example, you must pay BTC gas fees when interacting with the Bitcoin network.

- Minting: The creation process of an NFT.

- Moon: A typical financial market term referring to the exponential growth of an asset value. E.g. BAYC is going to the moon, or ‘mooning’.

- Reveal: When minting a new generative project, your artwork will be created by the platform after the minting process. This means you’re purchasing a ‘blind box’ and won’t know what you will get until it’s time to reveal it. Depending on the creator’s choice, the NFT may be informed immediately or after a 24-48 hours delay when the collection sells out.

- Secondary (transaction): A secondary NFT transaction is when a collection of NFTs is already sold through its project website and is further traded among buyers.

You can find the more expansive glossary list here.

Step 1: Decide what it is you are minting.

While some of the most popular projects like Bored Ape Yacht Club (BAYC) feature cartoon avatars and profile picture projects, remember that the platform can help you turn any digital files you own into an NFT. Many musicians like Kings of Leon and 3LAU have launched NFT projects for their singles, music videos and even album art. The fine line is to make sure that the NFT is your creation or something you rightfully own.

Step 2: Decide on a marketplace.

Many marketplaces allow you to discover, buy and sell NFTs, but depending on your identity as an individual creator and artist or a regular trader who sees this as an asset class; some are better suited for respective identities.

- OpenSea

Based on the Ethereum blockchain, OpenSea is the top choice of NFT creators and buyers. Signing up on OpenSea is free. Compared to other marketplaces, it boasts the most variety of digital assets available for browsing, buying and selling. It supports artists and creators with the easy minting process on OpenSea. Lastly, the marketplace supports more than 150 payment tokens.

What you’ll need to get started:

An ETH wallet (e.g. MetaMask, Coinbase or dozens of others)

Creator fees:

2.5% of your sale

Learn more:

Visit the OpenSea resource page.

—

- Rarible

Similar to OpenSea, Rarible utilises the Ethereum blockchain. Rarible is another large marketplace that can buy, sell and create all types of art, from videos to collectables and music on the platform. However, on Rarible, you have to use their own marketplace’s mainstay token Rarible (CRYPTO: RARI) to buy and sell on the market. The incredible feature for users on Rarible is that they can steal a “sneak peek” of your creation from everyone who comes to Rarible, limiting the complete project to purchasers only.

What you’ll need to get started:

An ETH wallet (e.g. MetaMask, Coinbase or dozens of others)

Creator fees:

Vary depending on the blockchain you use, but the option for free minting exists.

Learn more:

Read the Rarible FAQs

—

- Mintable

Mintable, the famous NFT marketplace backed by the shark billionaire Mark Cuban, is also a fabulous marketplace to start selling NFTs. Mintable allows creators to skip upfront fees when minting NFTs and rewards creators royalties whenever a collector resells their product on the secondary market. Compared to OpenSea, which has a flat rate of 2.5%, Mintable has creator fees ranging from 2.5% to 10%, depending on the type of transaction.

What you’ll need to get started:

An ETH wallet (e.g. MetaMask, Coinbase or dozens of others)

Creator fees:

2.5%, 5% or 10% depending on transaction type

Learn more:

To view the Mintable Resource page, you need to be a user of Mintable.

For further clarification, creator fees are not gas fees. Buyers pay gas fees (the transaction amount required to write data on a blockchain network) after the first sale of a specific NFT collection. Also, other fees may apply.

Other platforms like Foundation and SuperRare are by invite only; only by invitation are you allowed to create NFTs on their platform.

—

Step 3: Set up a Crypto Wallet to get Cryptocurrency

It might seem like a misordered step, but it isn’t.

Setting up a crypto wallet only after you have chosen your marketplace and blockchain is a better investment move as it is advisable to stick with one marketplace that allows you to have different altcoins to invest in. Altcoins are “alternative coins” for short, which are alternative coins other than Bitcoin, like Ethereum and Solana. Further, blockchains have additional gas fees, so it is advisable to research the market and cryptocurrency before setting up your crypto wallets.

Step 4: Join communities on Discord and Twitter

Do you still remember your Twitter password? To start making NFTs, you must recover your Twitter account and create an account on Discord. Discord works like Slack, an organisational channel that organises conversations into dedicated spaces called channels. Channels bring order and clarity, making them for a project, team or topic, and in these channels, you can share images and ideas and move work forward. Discord is a platform for gamers and crypto lovers, and Twitter allows you to chat with like-minded NFT collectors or even collectors interested in the same projects as you. You can enter various channels, though some tracks are by invite only. Most information regarding NFT news is communicated through Discord by the project’s founders. When you’re ready to sell your NFTs, you can expect your community to be your marketing resource and “hype central”.

You don’t need to spend much money on sophisticated tactics to create successful NFT projects. Just trust your community.

Step 5: Create your art, upload and mint

Creating art is easy and challenging at the same time. Before proceeding, you must decide if you’d like to do a 1:1 Art or a collection of NFTs. Remember, no prudent NFT creator would create a group without first knowing the longevity of the project and its goals. Doing copyright research is also essential, be diligent in pointing out key features of other top projects and then avoiding them. You are good to go as long as it is your creation and there’s nothing similar in the market.

In marketplaces such as OpenSea and Rarible and minting website Polygon, the minting process is so easy:

- Open the collection you just created

- Click on Add Item

- Upload your NFT and name it.

- Fill in the properties, levels and other descriptors for the NFT.

- Click Create when finished.

Once you mint your NFT, it will appear on your profile. Blockchain data is public and accessible by anyone. Your NFT’s buying and selling history will be available to the public forever on this digital ledger, helping you and prospective buyers track its price. You might not want people to know how many transactions you make or how much money you have traded. Therefore, many users go by different monikers to hide their identities.

Step 6: Selling your NFTs

After minting, it is time to price your NFT. For starters, you might want to try 1 ETH ($1691 as of 28 June 2022) to keep it simple. The 1 ETH price will remain on your marketplace profile until a specific date or until someone takes it off the market.

Mach37, combining Web2 and Web3 | Medium.com

Why are NFTs so significant in the web3 era?

Although the NFT space seems to be levelling in the bearish market in 2022, the growth of NFTs has changed the work of artists, content creators, graphic designers, illustrators, and authors. This revolutionary technology broke the internet, turning the art and fashion world upside down. At the end of 2021, the burgeoning market had a trading volume of approximately $23 billion. Cryptocurrency and NFTs are a mainstay in our web3 culture.

- NFTs open a gateway to creating more hybrid industries

Ten years ago, it would have been difficult to find a hybrid designer that could travel between art and science. But today, a designer can not only design graphics, and they can code the graphics, create 3D models using code and even code robots’ movements. A hybrid designer today believes in “innovation through synergy between creativity, science and technology to create value for society”.

Coding is no longer the sole proprietary of the engineering, technology, and financial technology sector; everyone has a chance to utilise coding. Today’s creatives can code their artworks to mint without any platforms and marketplaces and even create intelligent contracts through the Ethereum Blockchain without third-party platforms. This sight is one incredible example of how the art, design, and science industry coalesce, creating more hybrid initiatives that will stay in the future.

Read more here: https://www.rca.ac.uk/research-innovation/research-centres/computer-science-research-centre/

https://www.rca.ac.uk/study/programme-finder/information-experience-design-ma/

- NFTs foster marketplace efficiency

NFTs enable markets to be more streamlined. Transforming a physical asset into a digital one and embedding it into the blockchain technology streamline complex processes, eliminate intermediaries, enhance supply chains and bolsters security. NFTs are a starting point, and it shows that there are applications beyond marketplaces. Take physical paper contracts between businesses. By converting them into distinct NFTs, we can significantly curb bottlenecks at physical places and streamline the process of checking and authenticating them. This change can save us so many person-hours when time is a form of money today.

Read more here: https://www.cnbc.com/2022/02/02/here-are-the-pros-and-cons-when-it-comes-to-non-fungible-tokens.html

- The bolstering security of Blockchain Technology backing NFTs

Within the NFT space, we can see what blockchain technology can do in minting, buying, and selling in a virtual area. As mentioned, blockchain is essential because businesses run on information; the more accurately received, the better. Blockchain is ideal for delivering that information because it provides immediacy and transparency for the data stored on that immutable ledger which only permissible network members can access.

With the application on NFTs, we can track its entire history of orders, payments, differing accounts and production. We can use the single view of transparency, which gives its customers greater confidence to use Blockchain-applied applications in the future.

Bryce Durbin, TechCrunch | TechCrunch

Seems like a dream to earn big bucks?

Beware of the pitfalls.

With every new and exciting investment asset class, there are immense risks too. We see many success stories of earning the big dollars with cryptocurrency; people often forget the flip side of the coin that some people faced when Bitcoin crashed.

- NFTs are illiquid and speculative investments.

Since it is a new asset and marketplace, there is not a lot of historical data. In May 2022, Altcoin Solana crashed 85% in value due to a power outage and NFT spillover, which wiped out a lot of investors’ bank accounts. Can you afford the loss?

- NFTs are a volatile investment that sits in a decentralised space.

NFTs are termed “volatile” as with most art, digital or physical, their value is relative and based on someone else’s sentiment and the hype around it. Similar to the sneaker collectors world, there is a “cop or drop” hype, 1:1 and secondary market pricing. People flip in the secondary market at their sentimental price, unconcerned with any market research or statistical data as it swings with sentiments and is unpegged to any centralised currency.

That’s the unique nature of an NFT, which can be viewed as both a pro and a con. Further, altcoins sit in a decentralised space, where there are no government rules to how it is traded or how the market moves – everyone has a dip in the soup.

Unless you are using altcoins pegged to the U.S dollar, it is a considerable risk to dabble in cryptocurrency. Unless you can afford the loss, it is not recommended to invest in cryptocurrency or NFTs.

- There is a high potential for fraud and scammers within the space.

Despite blockchain technology, it is possible for NFTs to be hacked and stolen, adding another significant risk to consider. NFTs thefts are increasingly common as the number of bad-faith actors shows up in hopes of a breadcrumb of this multi-million-dollar pie. OpenSea has seen more than $10 million in losses from NFT hacks and thefts, with BAYC apes worth millions getting stolen.

Also, anybody can compromise the security of social networking sites like Discord and Twitter with phishing attacks, with hackers posing as NFT project founders posting fake links concerning ongoing NFT projects.

Plagiarism is also common in the digital space. DeviantArt has also seen artists’ collective being ripped off directly from their portfolios and onto OpenSea’s marketplace.

Read more here: https://mashable.com/article/bored-ape-yacht-club-hacked-again.

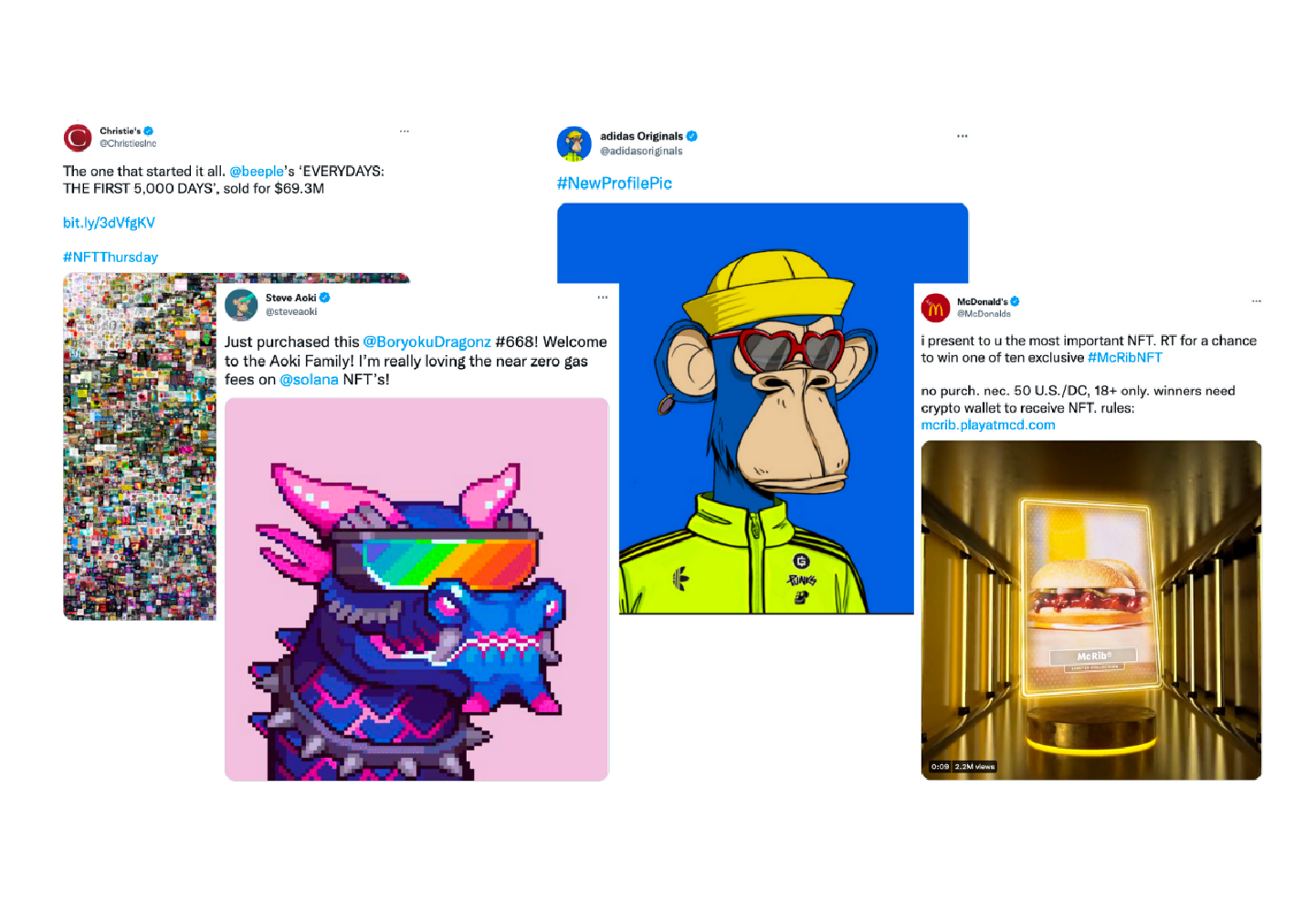

Big Brands getting into NFTs | Medium.com

Conclusion

Although big brands are jumping on the bandwagon to create NFTs and push the boundaries of their uses, NFTs remain in a highly speculative market that fluctuates wildly daily. With such a decentralised space, there is almost no kind of accountability. It will remain an unregulated unique digital asset with various technological applications in digital art, games, music, films and Internet memes. There is only moderate control and visibility in the space that remains in the private room. Unless it has merged fully with the Decentralised Finance space, If NFTs remain ungoverned, they will always hold it in a speculative market.

Boom or bust? It is up to you to decide!

Ps: Happy investing! Tangible is not liable for any investment losses or speculative investment solutions.

Share this article